Sometimes, You *Don’t* Want Focus

Author: Jurgen Appelo

Everyone always tells you to focus. “Don’t spread yourself too thin! Pick only one objective!” But focus is not always a smart strategy.

“Narrowing your focus is ‘a really good strategy in a safe environment, because it means you can learn things and flourish and develop. But if you are in a dangerous environment, selective attention [where you focus on just one thing] is a really dumb strategy. What you need instead is to evenly spread vigilance around your environment, looking for cues for danger.’” - Stolen Focus, Johann Hari

One exception to the idea of keeping focus is when you're working with a portfolio of options.

Startup investors know that they need to invest in twenty different ventures to have a reasonable chance of a good return on their investment. Each startup has maybe a 10% chance of succeeding. That means investors don't want focus; they want diversification to balance their portfolio.

You have a similar situation when you're a team managing a dozen high-risk experiments. When each of these experiments has a success rate of 10%, you need to wrap at least a dozen experiments inside one objective to get a 70% success estimate.

(When twelve experiments each have a success rate of just 10%, the chance of at least one of them succeeding is 72%. -- Probabilities were one of my favorite math topics in high school.)

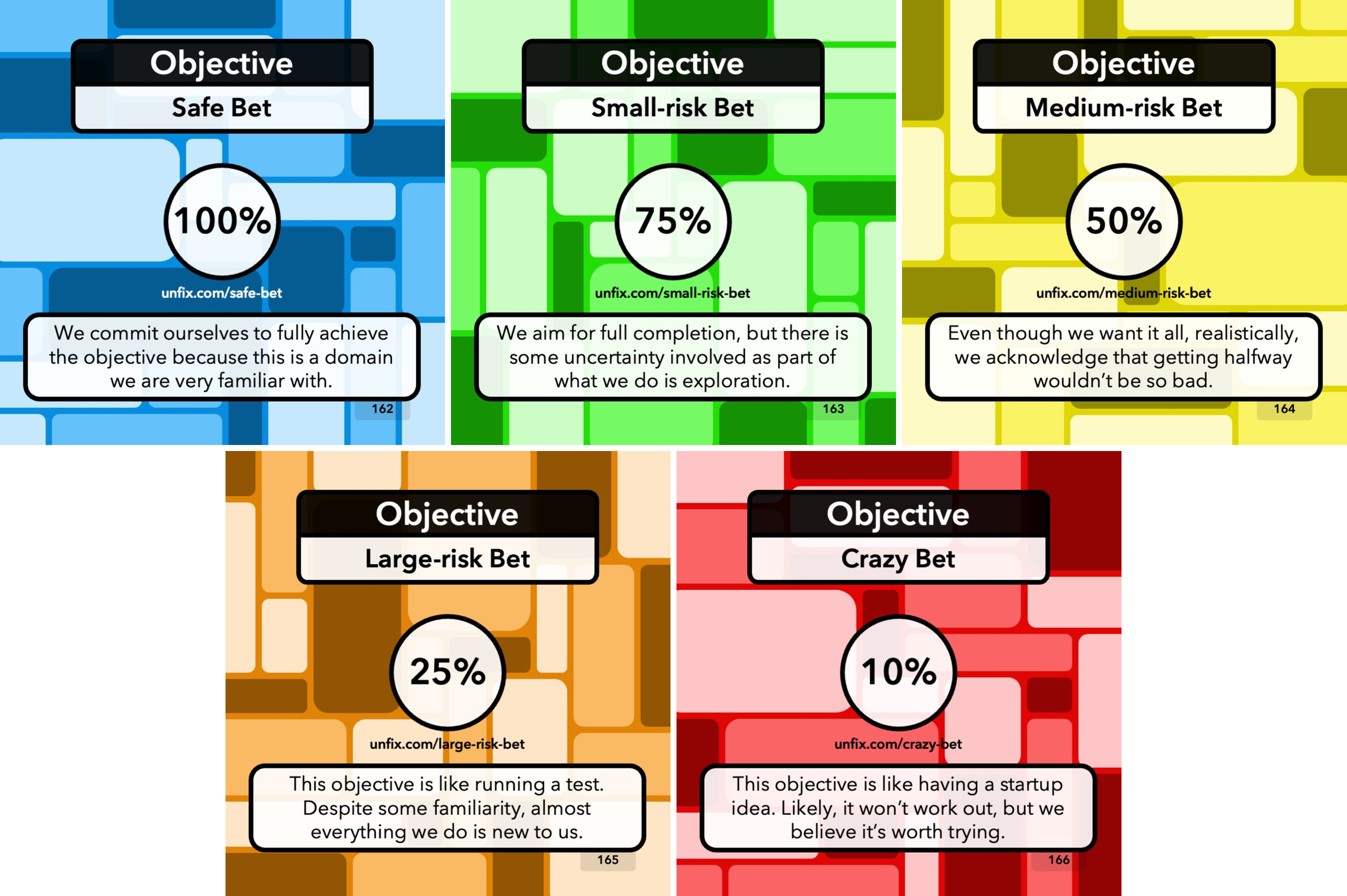

If, however, these experiments have bigger budgets and longer time frames, you can choose to manage an experiment portfolio with twelve OKRs, and each has a 10% success estimate. (I call them "Crazy Bets.") The principle of managing risk with a portfolio of parallel experiments remains the same, no matter the scale. Math is math.

Oh, and by the way … when you have only experiments among your objectives, you might consider calling them strategic bets. Among managers, bets are a better word than experiments and hypotheses. Managers don't like experimenting, but they love betting!

“I started to use the word "bet" and noticed something very interesting. Executives, who understand concepts like risk, return, investment, and diversification, dropped their resistance. Bets make sense. Bets can be big or small. Bets can be risky or safe. Good bets can sometimes lose, and bad bets can sometimes win.” - John Cutler